By Kate Shaw, Lauren Asher, and Stephanie Murphy

Community colleges are a vital component of the American education system, providing affordable access to higher education and workforce training for millions of students each year. Additionally, they can help to fill talent gaps and contribute to economic growth and competitiveness.

Yet, despite their importance, much of the considerable potential of community colleges to improve economic outcomes and equity of opportunity for all Americans remains unrealized because of a significant funding crisis. Many community colleges struggle to meet the needs of their students due to both inadequate funding and ineffective finance systems.

But little is really known about community college finance systems: not just particular policies or revenue streams, but the way they combine to create state-specific conditions and incentives for colleges. How do these systems drive or reduce inequities in campus funding, student access, and student outcomes? What do policymakers need to know about their own state’s community college finance system to make it more equitable and effective?

Understanding how these institutions are funded and the challenges they face in securing adequate funding is crucial for policymakers, educators, and students alike. Inadequate funding and ineffective finance systems can result in reduced course offerings, limited student support services, increased tuition and fees, and persistent outcomes gaps, which can drive inequity and create barriers to access and success for many students.

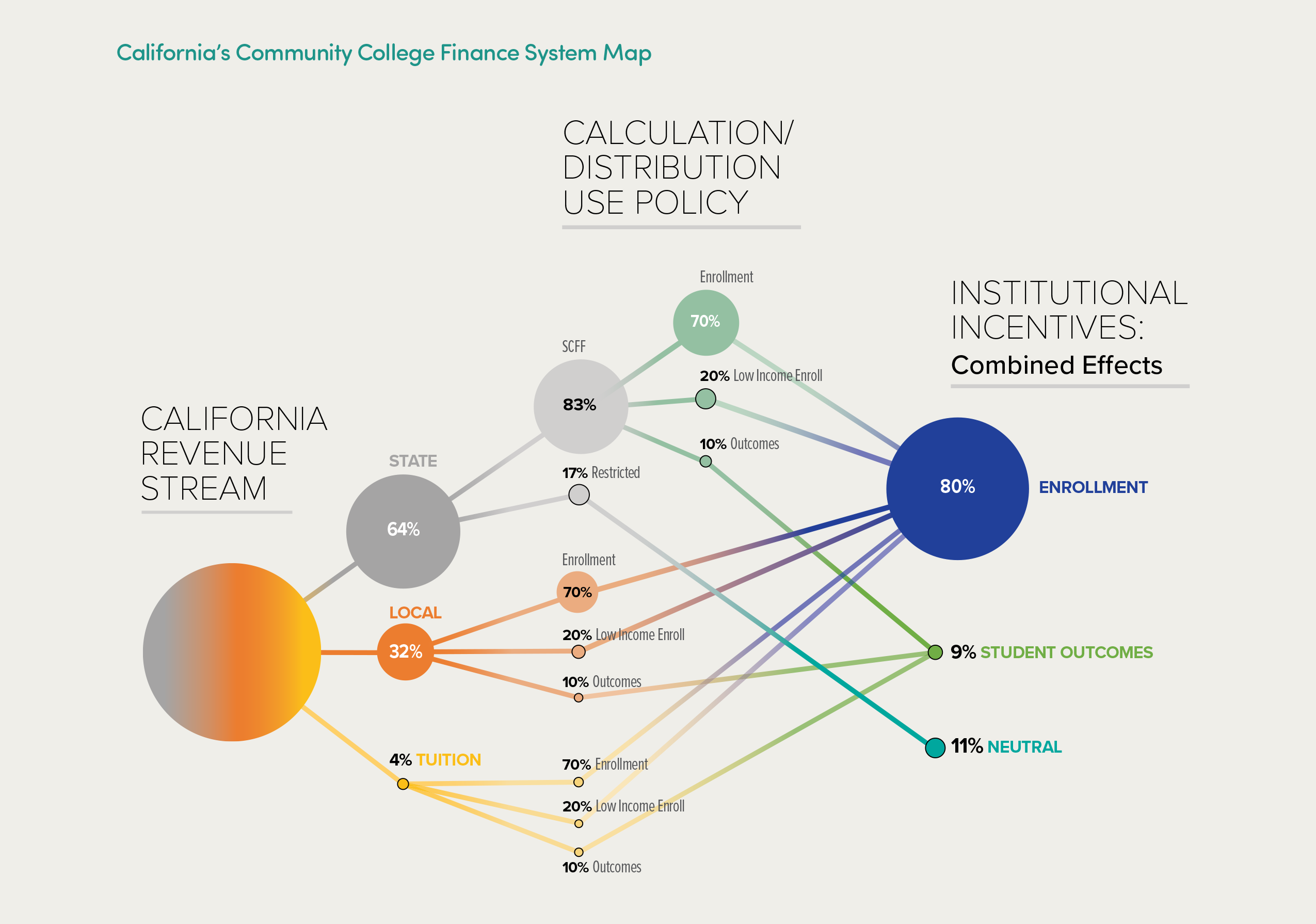

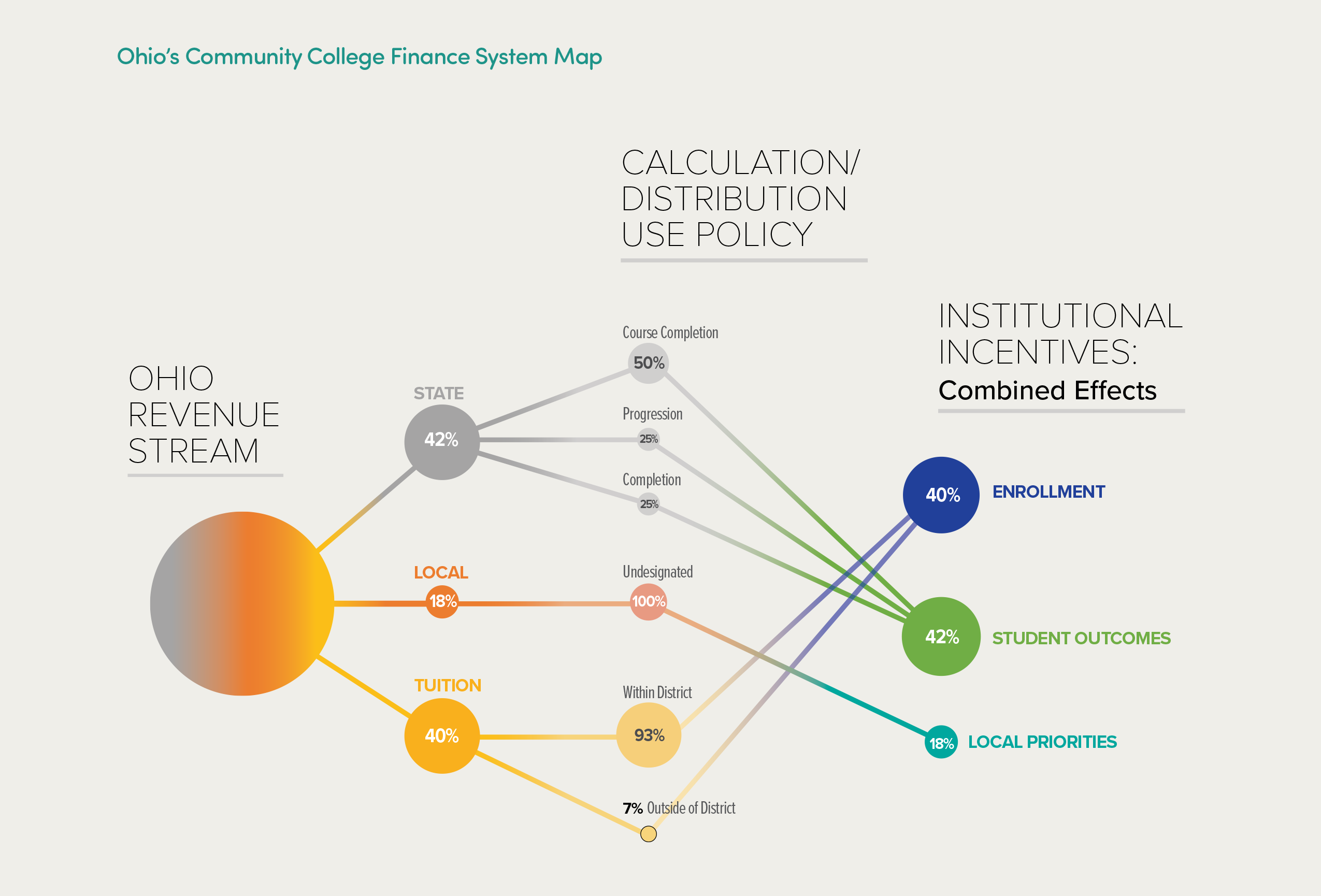

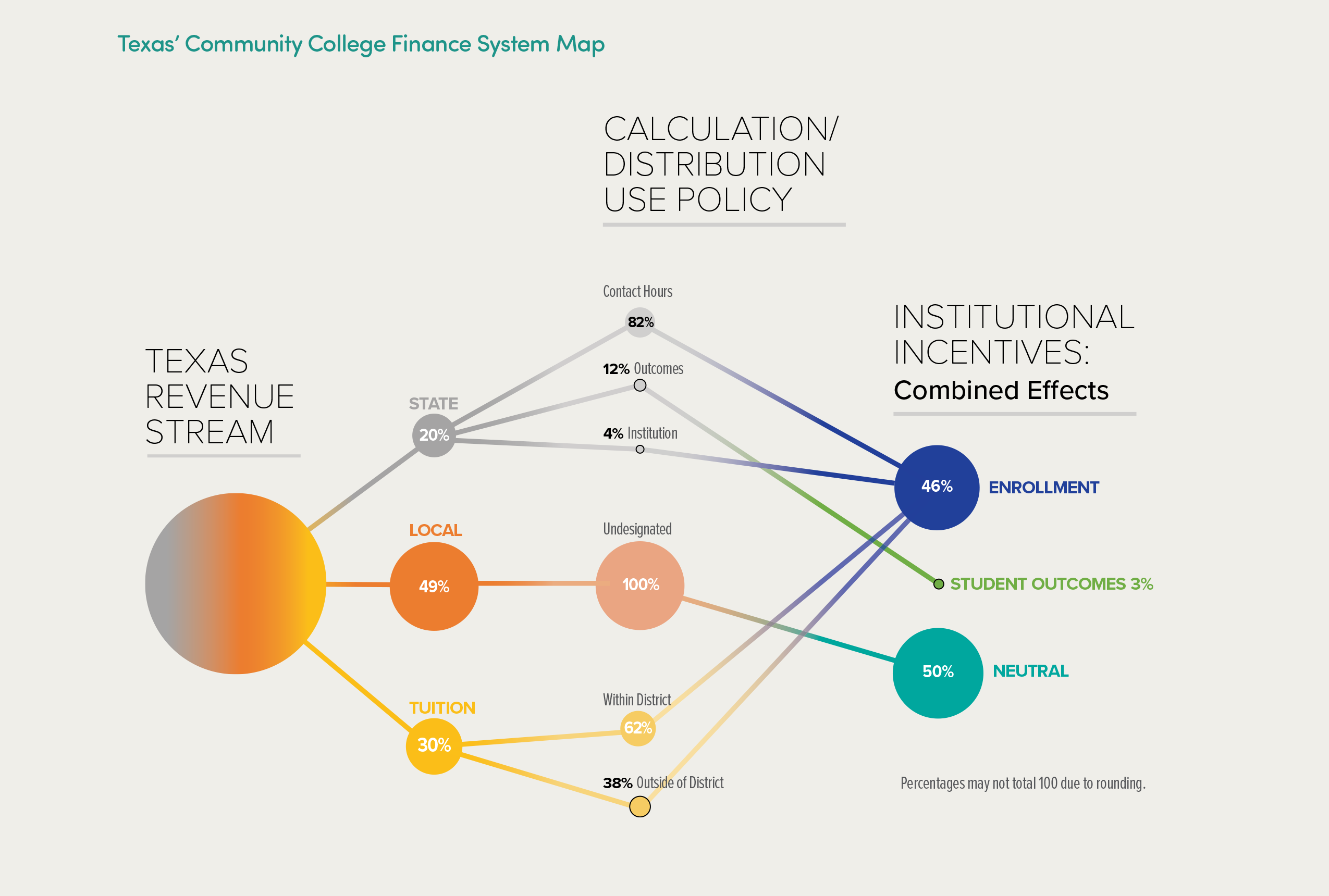

In a new report—Mapping Community College Finance Systems to Develop Equitable and Effective Finance Policy—we provide answers. Our report reveals the diversity and complexity of state finance systems, and how to identify the often competing incentives within them, by comparing the systems of three very different states: California, Ohio, and Texas.

For this project, we conducted extensive research, engaged with state policymakers, and created an analytical framework to fill a major gap in existing research, which largely focuses on individual elements of community college funding or policy rather than how they all add up. In contrast, our report’s maps of the California, Ohio, and Texas finance systems include:

- The share of total funding from each of three main revenue streams: state appropriations, tuition, and recurring local revenue;

- the policies that control how those revenues are generated, distributed, and used;

- the combined incentives for colleges; and

- the distinct equity implications for institutions and for students.

We offer a clear, four-step framework for mapping state finance systems.

Step 1: MAP MAJOR REVENUE SOURCES. Determine the proportion of total revenue drawn from each of three major community college revenue sources: state appropriations, tuition, and local recurring revenue.

Step 2: MAP POLICIES. Indicate how each revenue stream must be calculated, allocated, and/or spent according to laws or regulations.

Step 3: MAP INCENTIVES. Determine whether and how each revenue stream and related policies create incentives for community colleges.

Step 4: MAP EQUITY IMPLICATIONS. Determine how revenue streams and related policies positively or negatively affect equitable funding across institutions and equitable outcomes for students.

What did we learn from our research? We discovered that:

- Even though each of the three state’s finance systems includes a student-centered funding formula, the percentage of total revenue directly tied to student outcomes ranges widely, from 3% in Texas and 9% in California to 42% in Ohio. These differences are due to the intersection of the formula’s design, the share of total funding the formula controls, and the prominence of other funding streams.

- All three state finance systems strongly incentivize community colleges to focus on enrollment, with 80% of total revenue tied to enrollment in California, 40% in Ohio, and 46% in Texas.

- Relying on local revenue does not necessarily lead to inequitable funding between colleges. Some states, such as California, have policies that level the funding playing field, while others do not.

- Net incentives for community colleges to increase equity in student outcomes are highest in Ohio and lowest in Texas, while California’s finance system prioritizes equity in student access.

Ultimately, there is no simple recipe for developing an equitable, effective community college funding system. But understanding the challenges facing community colleges and the finance systems that underpin them can provide insights to help policymakers, educators, and advocates develop new approaches to funding that better support community colleges and their students, ensuring that community colleges continue to play a vital role in providing access to higher education and critical workforce training for all.

Kate Shaw is the deputy secretary of postsecondary and higher education in Pennsylvania, Lauren Asher is an independent consultant with the Senior College and University Commission, and Stephanie Murphy is the director of state policy & research at HCM Strategists.